Blockchain and Cryptocurrency News

Bancor v2.1 Staking for (DeFi) Dummies

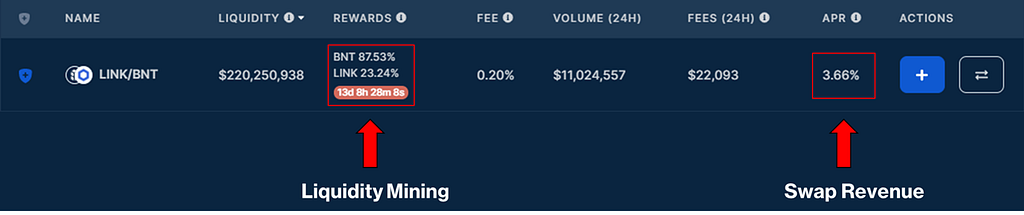

The post provides a high-level overview of staking in single-sided liquidity pools on bancor.networkhttps://medium.com/media/d7ac7a07299bff6a05f8826770f23169/hrefContents:Single-Sided LiquidityImpermanent Loss ProtectionLiquidity Mining