Polygon (MATIC) Yield Farming Guide

Last year summer had a lot of yield farming activity operating on the ethereum and they are every indication that most yield farming will take off on polygon henceforth and […]

Crypto Gator | The Best Cryptocurrency, Blockchain and Forex News Aggregator

Crypto Gator | The Best Cryptocurrency, Blockchain and Forex News Aggregator

The Best Cryptocurrency, Blockchain and Forex News Aggregator

Last year summer had a lot of yield farming activity operating on the ethereum and they are every indication that most yield farming will take off on polygon henceforth and […]

Last year summer had a lot of yield farming activity operating on the ethereum and they are every indication that most yield farming will take off on polygon henceforth and the major indicators driving this position are:

Before now, there have been concerted efforts by organizations like flash bots and Binance smart chain but they all have in a way or another been beguiled by issues such as flash loan attacks and hacks.

The earnest quest for low fees and fast transactions gave rise to the polygon and many yield farmers are taking advantage of this to make the most of their yield farming experience.

Polygon uses a proof of stake consensus algorithm which is why the cost of transacting on its network is just a fraction of the cost of transacting on Ethereum network.

They are myriads of earning options available for DeFi users hoping to get a high yield on their crypto assets.

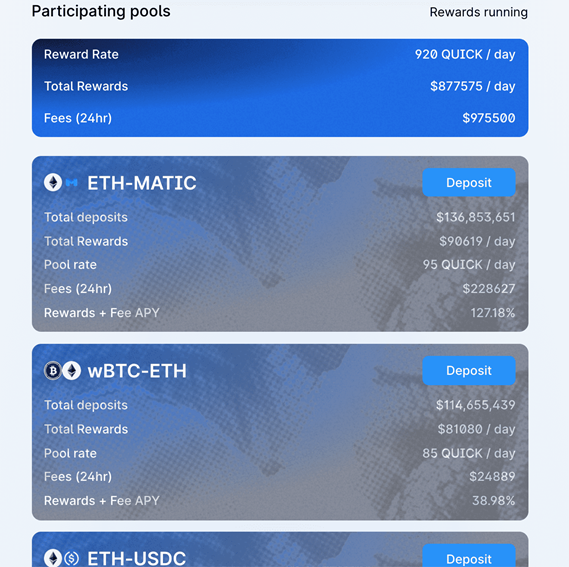

The first option on Polygon is the Quick Swap; it’s the most popular exchange on the polygon network, it has low transaction fees/gas fees with a high volume resulting in high commissions for liquidity providers (LP). The APYs get boosted when liquidity providers (LP) get quick rewards on certain pools and these rewards range from the allotted 30% on stable coin pairs to 200% if the trading pairs include QUICK.

Other exchanges like Sushiswap and Curve also offer mouth-watering Matic rewards on top of the fees for their liquidity pools.

Users can entrust their liquidity tokens to yield aggregators like yearn. Finance on Ethereum network.

Users can boost their returns when they use the yield aggregator to reinvest their profits in the same pools. The APYs on polygon have even grown a bit higher because platforms like Adamant Finance have also launched their governance token and the liquidity pool tokens for Sushi’s USDT/USDC pool currently have a 99% APY earning potential.

Just as anticipated, the classic yield farms are back and better and the most popular so far being the polywhale. Users have the liberty of staking their cryptocurrencies in the polywhale’s pool and they will get its KRILL native token in exchange.

It’s also important for users to know that for every of their crypto deposits, a portion will be used to repurchase KRILL from the market. At the moment users are entitled to earning up to 80% APY by just staking MATIC, then proceed to harvest the KRILL rewards and then deposit them back into their pool to get up to 2,500% APY, which is quite lucrative. However; there is a need for users to know that the KRILL token price can be volatile and the farms are highly experimental and so taking this risk into cognizance will give every user a smooth sail in the Defi yield farming polygon sphere.

The layer two blockchains of the polygon (Matic) DeFI are gaining serious traction over the Ethereum network, they have been a significant expansion of the Ethereum DeFi projects into the polygon ecosystem. These projects are sushiSwap and Curve. They have also been quite a several yield farming platform emerging originally the polygon blockchain. This review will be espousing on three (3) native protocols namely QuickSwap, PolyZap, and Polycat Finance.

You are completely at liberty to deposit your choice amount of liquidity pool tokens to the Quickswap protocol governance token ($QUICK).

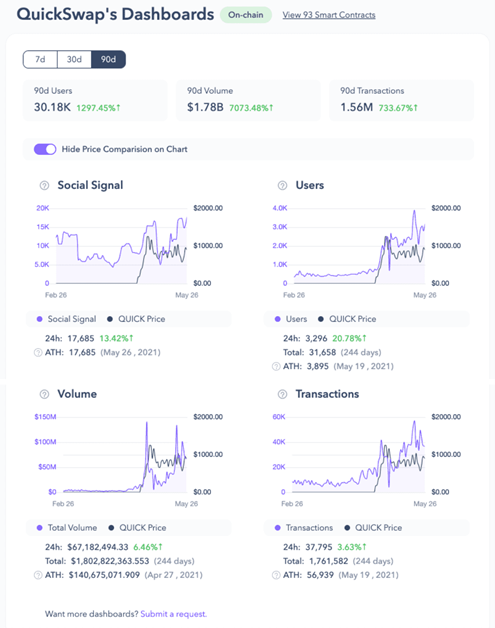

There seem to have been a tremendous 1297.45% user increase in 90d and a corresponding 7073.48% volume increase in the 90d volume.

This looks good thus far, Quick token price shows a high correlation with the existing Quickswap’s on-chain data.

At the moment annual percentage yields (APYs) for Quickswap’s liquidity mining processes range from 20% to over 180000% on BIFI-QUICK pairs. There is a need to also take into consideration the risk of impermanence loss because liquidity provision is required.

notwithstanding QuickSwap’s on-chain performance is amazing and it’s witnessing a surge since Apr.

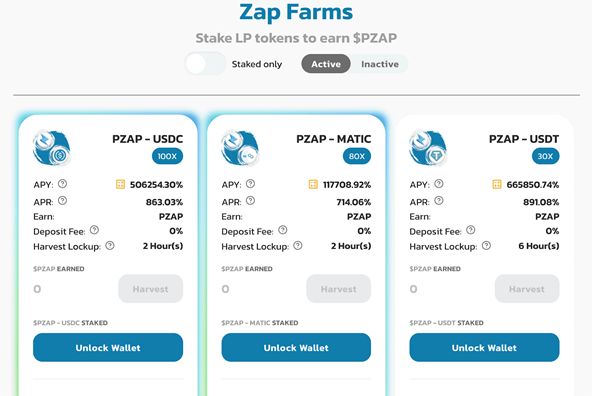

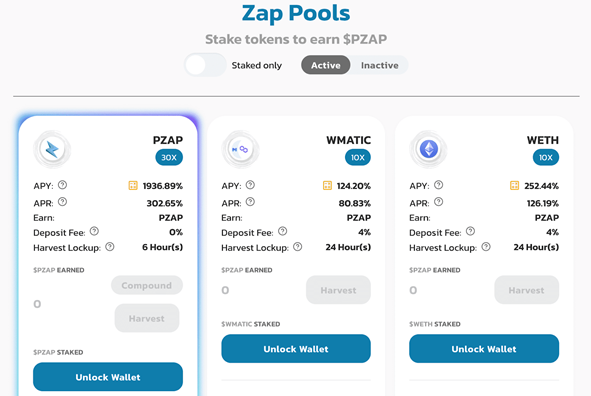

PolyZap farm is also a layer 2 Dex as well as a yield farming project featured on the polygon. Its Zap farm and Zap cloud pools allow users to earn $PZAP, the PolyZap ecosystem is fueled by staking liquidity pool tokens or any other tokens.

1.Zap Farms: Stake your LP tokens to earn $PZAP.

2.Zap Pools: Stake single tokens to earn $PZAP.

The dashboard above clearly indicates the $PZAP token price is highly correlated with PolyZap Farm