How to trade forex automatically and make a passive income | CTrend FX – Automated Forex Trading Signal

How to trade forex automatically and make a passive income | CTrend FX – Automated Forex Trading Signal

Crypto Gator | The Best Cryptocurrency, Blockchain and Forex News Aggregator

Crypto Gator | The Best Cryptocurrency, Blockchain and Forex News Aggregator

The Best Cryptocurrency, Blockchain and Forex News Aggregator

How to trade forex automatically and make a passive income | CTrend FX – Automated Forex Trading Signal

Last year summer had a lot of yield farming activity operating on the ethereum and they are every indication that most yield farming will take off on polygon henceforth and […]

Financial & asset trading is an age-long engagement, it’s basically the buying and selling of financial assets in various shades using automated tools and technology. ZuluTrade is one of the […]

Here at CryptoGator, we make an emphasis on Crypto Education and keeping our readers informed about the financial world. The foreign exchange market commonly known as Forex market is a […]

Web Hosting Review: InterServer

Cryptocurrencies are a digital form of money, implying that they are purely digital

Crypto Highlights: MicroStrategy buys more bitcoin, India to tax crypto gains, Dow Jones to launch crypto indexes, ETH Fund to debut on Toronto stock exchange, Genesis Block acquires OMG: there […]

Crypto and Blockchain Highlights: Bitcoin market cap bridges ATH, ETH 2.0 launch date confirmed, XRP surges to 2-year highs, PayPal going big on Bitcoin, S. Korea moves to ban privacy […]

Crypto Highlights: PayPal BTC record trading volume at Binance.US, Bitcoin ATMs up by 85% this year, $7.6B stolen in crypto since 2011, Value DeFi protocol hacked, Yet another BCH fork: There is more in this week

Best Practices To Follow In Securing Your Cryptocurrency Holdings

Crypto Highlights: Lebanon to launch digital assets, DeFi hacks are on the rise, New Jersey introduces Crypto License, Cred files for bankruptcy, KuCoin recovered 84% of stolen crypto: more interesting details below!

Quadratic funding is a new approach to crowdfunding that incentivizes smaller contributions and promotes the funding of diverse, high-quality projects. Read More

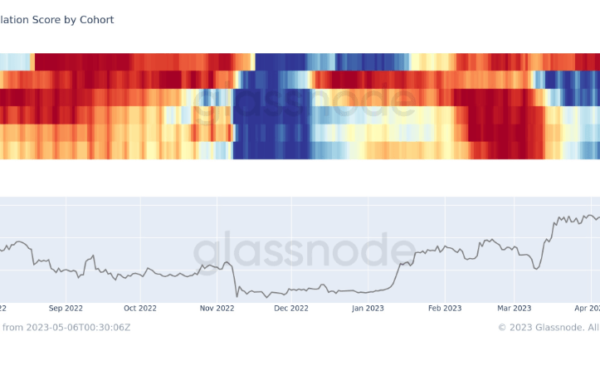

Quick Take May 5 saw the sixth biggest outflow of Bitcoin from exchanges since the start of the year. Roughly $240 million worth of Bitcoin was driven primarily by large […]

Crypto miners paid millions of dollars in energy fees last year following the regulation of mining activities. Read More

Memecoin hype fuels Bitcoin transaction costs, BTC miners block rewards surpass $50 billion and AI’s “Godfather” warns of technology dangers. Read More

Web3 companies can utilize the Stripe-hosted fiat-to-crypto on-ramp to allow customers to buy crypto at the “precise moment they need it.” Read More

The post Top Altcoins to Watch Next Week: SOL, XRP, ADA Price May Breakout Soon appeared first on Coinpedia Fintech News In a week influenced by a series of macro […]

The credentials will “have multiple use cases,” including regulatory compliance for banking and decentralized finance, age verification for e-commerce, private logins and fundraising. Read More

The post Memecoin Mania: What To Expect From PEPE, SHIB, DOGE Price Next Week? appeared first on Coinpedia Fintech News In the dynamic crypto market, memecoins have swiftly seized the […]

The post Conflux (CFX) And The Uwerx (WERX) Presale To Skyrocket As Per This 2023 Crypto Price Prediction appeared first on Coinpedia Fintech News Most veteran investors know that the […]

The post Fantom (FTM), Avalanche (AVAX), And Collateral Network (COLT) Are Experts’ Top Cryptocurrency Picks For 2023 appeared first on Coinpedia Fintech News As the cryptocurrency landscape continues evolving, investors […]